The 9-Minute Rule for Vancouver Tax Accounting Company

Wiki Article

Getting The Cfo Company Vancouver To Work

Table of ContentsThe Buzz on Tax Accountant In Vancouver, BcThe Only Guide to Tax Consultant VancouverWhat Does Virtual Cfo In Vancouver Mean?The Of Pivot Advantage Accounting And Advisory Inc. In Vancouver

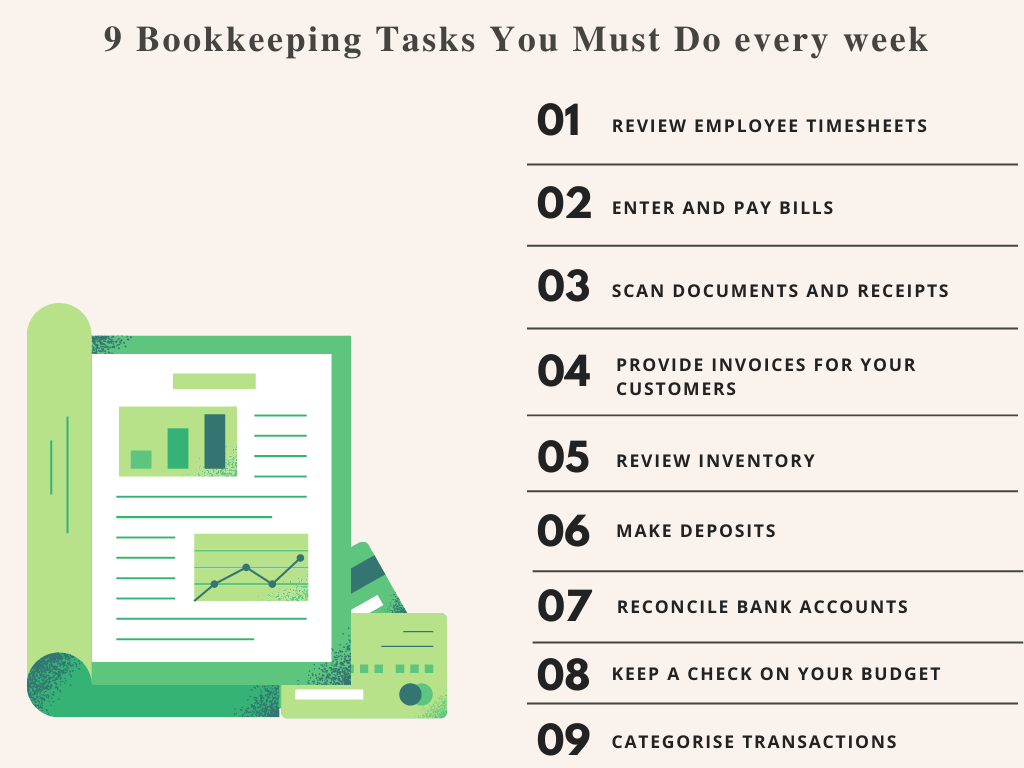

Not just will keeping cool files as well as documents aid you do your job extra successfully and also accurately, however it will certainly likewise send a message to your employer and customers that they can trust you to capably manage their economic details with regard and also integrity. Knowing the many tasks you have on your plate, recognizing the due date for each and every, as well as prioritizing your time appropriately will make you a significant property to your company.

Whether you maintain a detailed calendar, set up regular reminders on your phone, or have a daily order of business, stay in cost of your timetable. Bear in mind to continue to be versatile, nevertheless, for those urgent requests that are thrown your way. Merely reconfigure your priorities so you remain on track. Even if you like to hide out with the numbers, there's no navigating the reality that you will be needed to communicate in a range of means with colleagues, supervisors, clients, and also sector experts.

Also sending well-crafted emails is an essential skill. If this is not your strength, it might be well worth your effort and time to get some training to raise your worth to a potential company. The audit area is one that experiences routine change, whether it remain in policies, tax obligation codes, software, or finest techniques.

You'll learn vital assuming abilities to help figure out the long-term goals of an organization (and also develop plans to attain them). Read on to discover what you'll be able do with a bookkeeping degree.

Getting My Virtual Cfo In Vancouver To Work

Exactly how a lot do accountants and also accounting professionals bill for their services? Customarily, the solution is it depends, but this write-up will certainly offer details on the typical per hour invoicing method along with exactly how we price our services right here at Avalon. Just how much do bookkeepers and also accountants bill for their services? As normal, the solution is it depends, yet this post will certainly give details on the conventional hourly payment method in addition to how we value our solutions here at Avalon.To understand rates, it's handy to understand the distinction in between accounting and accounting. These 2 terms are typically utilized mutually, but there is a considerable distinction in between accounting and also audit services. We have actually composed in information about, but the very standard feature of a bookkeeper is to tape-record the purchases of a business in a consistent means.

Under the conventional technique, you won't understand the quantity of your expense till the job is full and the provider has included up all of the minutes spent working with your data. This is a common rates technique, we find a pair of points wrong with it: - It creates a circumstance where customers feel that they shouldn't ask inquiries or find out from their accountants as well as accountants due to the fact you could try these out that they will certainly be on the clock as quickly as the phone is answered.

Some Known Incorrect Statements About Outsourced Cfo Services

Just utilize the discount coupon code to obtain 25% off on check out. Plus there is a. If you're not pleased after finishing the course, just connect and also we'll provide a complete refund without any concerns asked. Since we've described why we don't like the typical design, allow's take a look at just how we price our services at Avalon.

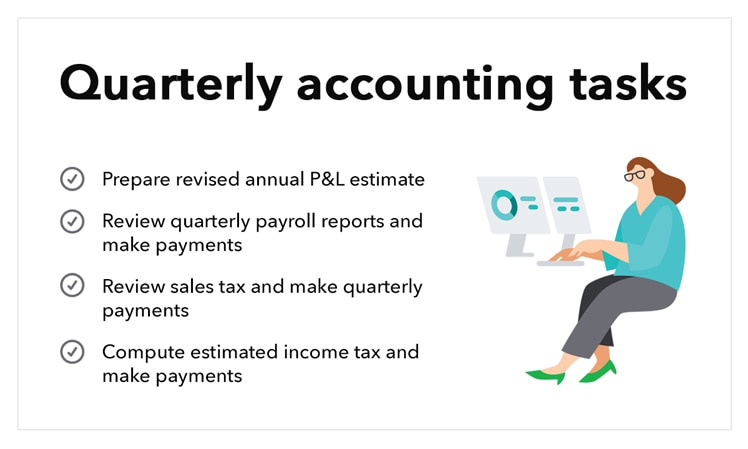

we can be offered to assist with accounting as well as bookkeeping inquiries throughout the year. - we prepare your year-end economic declarations and tax return (small business accountant Vancouver). - we're right here to aid with questions as well as support as needed Systems configuration as well as one-on-one bookkeeping training - Yearly year-end tax filings - Guidance with inquiries as needed - We see a great deal of small companies that have annual income in between $200k and $350k, that have 1 or 2 staff members and also are owner handled.

Strong month-to-month coverage that includes insight from an outdoors consultant is a crucial success factor below. - we established up your cloud accounting system and show you just how to send files digitally and also view reports. - we cover the price of the accounting software application. - we record month-to-month deals as well as send out valuable financial reports once each month.

The Basic Principles Of Tax Accountant In Vancouver, Bc

We're also offered to respond to questions as they come up. $1,500 for accounting and pay-roll systems configuration (single price)From $800 monthly (consists of software program charges and also year-end expenses billed regular monthly) As organizations grow, there is typically an in-between size where they are not yet huge enough to have their own internal money department but are our website complicated enough that just employing an accountant on Craigslist won't suffice.Report this wiki page